amazon flex tax documents canada

Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the. Jamie oliver aubergine curry.

Stride Mileage Tax Tracker Apps On Google Play

This is the non-employee compensation 1099 form you receive from Amazon Flex.

. Internal Revenue Service regulations your Amazon Flex 1099 form download to be available by January 31st. Or other proprietary information including images text page layout or form of Amazon without express written. What is Amazon Flex.

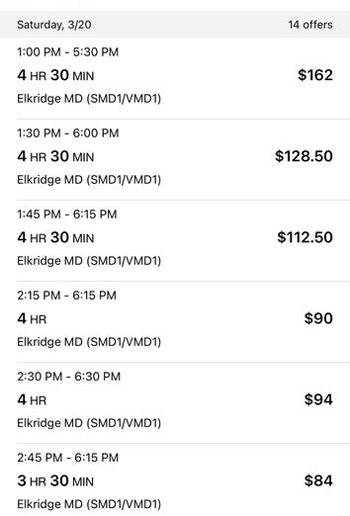

Click ViewEdit and then click Find Forms. With Amazon Flex you work only when you want to. 1825 - 1900 an hour.

Providing your consent will allow you. Click Download to download. Youll need to submit a tax return online declaring your.

You can find your Form 1099-NEC in Amazon Tax Central. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. 1099 MISC Forms 2021 4 Part Tax Forms Kit for 50 Individuals Income Set of Laser Forms - Designed for QuickBooks and Accounting Software - No Envelopes 2021 1099 Tax Forms- 46.

Amazon Delivery Driver - Chandler AZ. You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am.

You use your own vehicle to deliver packages for Amazon as a way of earning extra money to move you closer to your goals. Here are some of the most frequently-received 1099 forms received by Amazon drivers. Ad We know how valuable your time is.

Sign in using the email and password associated with your account. The forms are also sent to the IRS so take note if youve made more than 600. You expect to owe at least 1000 in tax for the current.

Get started now to reserve blocks in advance or pick them daily based on your schedule. Welcome to the Amazon Flex program the Program. Tax Returns for Amazon Flex Youll need to declare your Amazon flex taxes under the rules of HMRC self-assessment.

In order for Amazon to provide an electronic version of your tax information reporting Form 1099-MISC the IRS requires that Amazon obtain your consent. The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after.

![]()

Frequently Asked Questions Us Amazon Flex

Are Legal Settlements Taxable What You Need To Know

Stride Mileage Tax Tracker Apps On Google Play

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Anyone Else Getting This Exactly 5000 00 Pay For 2019 I Have Trouble Believing That My Random Blocks And Whole Foods Flex Delivery Work Paid Me Exactly 5000 00 R Amazonflexdrivers

How To File Amazon Flex 1099 Taxes The Easy Way

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Amazon Flex Driver How To File Your Taxes In 2022 1099 Nec Youtube

23 Apps Jobs Like Amazon Flex To Earn Money Making Deliveries Appjobs Blog

How To File Amazon Flex 1099 Taxes The Easy Way

How To File Amazon Flex 1099 Taxes The Easy Way

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Amazon Tax Guide For Canadian Sellers In The United States Canada Baranov Cpa

Rideshare Retailers Brace For Tough U S Independent Contractor Rule Reuters

How To Apply For Amazon Flex Driver Jobs Career Info

Hudson Pacific Cpp Investments Acquire Amazon Occupied Tower In Seattle Puget Sound Business Journal