is property tax included in mortgage loan

Lets say your home has an assessed value of 100000. If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

Mortgage Loans Interest Rates Lenders Everything To Know Los Angeles Times

Lets say your home has an assessed value of 200000.

. The homeowner can create a savings account and receive interest payments towards paying the property tax. Your property taxes are included in your monthly home loan payments. Your monthly payment includes your mortgage payment consisting of principal and interest as well as.

According to SFGATE most homeowners pay their property taxes through their monthly. Property taxes are included as part of your monthly mortgage payment. So if youre putting down 20 or more on a purchase.

Property taxes can be included in your mortgage payment at your option if your loan-to-value LTV ratio is less than 80. Lenders will also require as they do for property taxes that owners deposit an extra two months of insurance payments in their escrow account. Learn what you can include in your property tax.

If your county tax rate is 1 your. When you pay off your mortgage in full you also take over responsibility for ensuring your property tax gets paid in full and on time. If your home is worth 250000 and your tax rate is 1 your annual bill will be 2500.

The answer to that usually is yes. How much you pay in taxes depends on your homes value and your governments tax rate. When solely paying as part of the mortgage there is no.

With some exceptions the most likely scenario is that your. Property taxes are included in mortgage payments for most homeowners. Updated September 18 2022.

Lenders often require you to pay for. There are many reasons why your monthly payment can change. Homeowners insurance is not included in your mortgage its an insurance policy thats completely separate from your loan agreement.

If your county tax rate is 1 your property tax bill will come out to. Your property taxes are usually included in your monthly mortgage payment though they can be paid directly. Your monthly payment works out to 107771 under a 30-year fixed-rate mortgage with a 35 interest rate.

This calculation only includes principal and interest but does not. At closing the buyer and seller pay for any outstanding. Assessed Value x Property Tax Rate Property Tax.

If you qualify for a 50000. These extra two months again act as an. DHI Mortgage Property Taxes and Escrows.

All you have to do is take your homes assessed value and multiply it by the tax rate. Up to 25 cash back Property Tax and Mortgage Deductions Property Tax and Mortgage Deductions Deducting Your Property Taxes. If you get a home loan through a private lender then technically.

Property Tax Deduction A Guide Rocket Mortgage

How To Read A Mortgage Loan Estimate Nextadvisor With Time

Mortgage Payments Explained Principal Escrow Taxes More

Are Property Taxes Included In Mortgage Payments Smartasset

Mortgage Banker In Los Angeles Ca Flyers

The Ultimate Guide To North Carolina Property Taxes

Escrow Accounts The Bank Of Missouri

Is Your Mortgage Considered An Expense For Rental Property

Real Property Tax Howard County

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

Property Tax Your Mortgage Credit Com

Understanding California S Property Taxes

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

Are Property Taxes Included In Mortgage Payments Smartasset

Solved 46 Of 75 Mortgage Lenders Provide Borrowers With A Chegg Com

Property Taxes And Your Mortgage What You Need To Know Ramsey

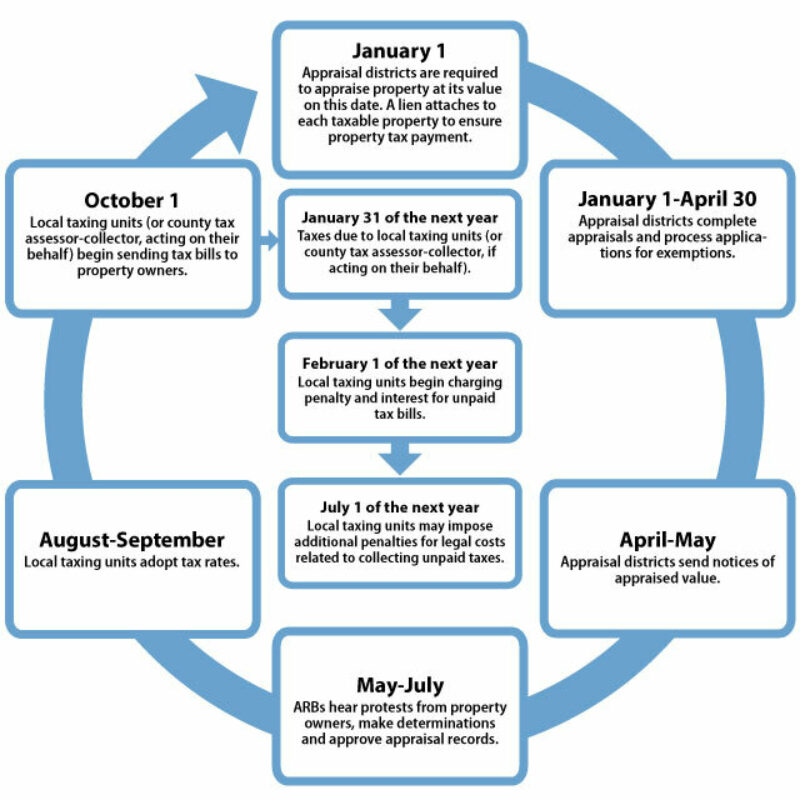

All About Property Taxes When Why And How Texans Pay

What Am I Paying For With My Monthly Mortgage Payment

Why Are My Property Taxes Higher Than My Neighbor S Credit Com